Donor-Advised Funds (DAFs) can be an incredibly impactful vehicle in philanthropy—on average DAF gifts are 10 times larger than a credit card donation. Yet, for many fundraising teams, DAF gifts create administrative headaches and missed stewardship opportunities.

DAFpay changes that—bringing simplicity, clarity, and speed to the DAF giving process, all while ensuring fundraising teams receive gifts with full donor attribution in real time. That’s why GiveCampus has partnered with Chariot—creators of DAFpay—to offer our Partners a fast, secure, and reliable way for their donors to contribute via their Donor-Advised Fund.

This exciting partnership goes far beyond helping annual giving secure more dollars and will benefit entire advancement teams from frontline fundraisers to advancement services. In this blog, we’ll explore how DAFpay addresses common DAF-related challenges across your advancement team and share tips on maximizing support from DAF donors.

WEBINAR: Learn how to unlock DAFpay on GiveCampus

Advancement Services: Eliminate the Guesswork, Save Time

Many advancement teams are all too familiar with fielding gifts from donor-advised funds that arrive with details about the fund but nothing about the donor. This creates a logistical nightmare, that often means hunting through records, emailing across departments, and hoping someone can suss out which constituent made the gift. This detective work is slow, error-prone, and frustrating.

With DAFpay, advancement services can process DAF gifts with the same ease and accuracy as credit card gifts—dramatically reducing time spent manually reconciling gifts. Additionally, solving for attribution issues helps improve data accuracy for stewardship and compliance.

DAF Best Practices for Advancement Services

- Integrate DAFpay with your gift processing systems: Ensure DAFpay is directly tied into your donation and database platforms to enable real-time matching and reduce duplicate manual entries.

Pro Tip: DAFpay integrates with GC Online Giving—free of charge!

- Train your team on DAF identifiers: If you don’t have a DAFpay integration, familiarize staff with common fund providers (e.g., Fidelity, Schwab) and the typical data formats that accompany their disbursements to speed up troubleshooting when needed.

BLOG: How Advancement Services Drives Institutional Impact

Donor Relations and Alumni Engagement: Steward with Speed and Confidence

Lack of attribution isn’t only an issue for advancement services. Unattributed gifts can leave donor relations teams in the dark. Who should be thanked? What impact story can be shared? Without knowing who gave, teams can’t steward effectively—or worse, they may miss additional gift opportunities.

DAFpay solves this, providing instant visibility into donor identity, enabling accurate, fast follow-up that builds donor trust, loyalty, and long-term giving potential.

DAF Best Practices for Donor Relations and Alumni Engagement

- Develop Personalized Stewardship: Craft thank-you letters specifically for DAF donors, acknowledging their unique giving method. Because donors receive their tax deduction when they contribute to the DAF—not when they recommend a grant to your institution—your confirmation and stewardship email will just contain a warm acknowledgment of the grant and exclude any tax receipt information other types of donors may receive in their confirmation communications.

- Maintain Regular Communication: Keep DAF donors informed about the impact of their contributions through newsletters, impact reports, and personalized updates. This ongoing engagement fosters a deeper connection and encourages future support.

BLOG: 5 Donor Stewardship Best Practices

Annual Giving: Unlock More Giving from Younger Alumni

You may have younger donors who want to contribute meaningfully but hesitate to draw from personal funds. However, this is a missed opportunity. While baby boomers still make up the majority of DAF owners, this giving vehicle is seeing a surge in popularity among donors under 40. This generation is often motivated by outcomes, transparency, and the tangible impact of their giving—making DAFs an appealing tool for purpose-driven philanthropy.

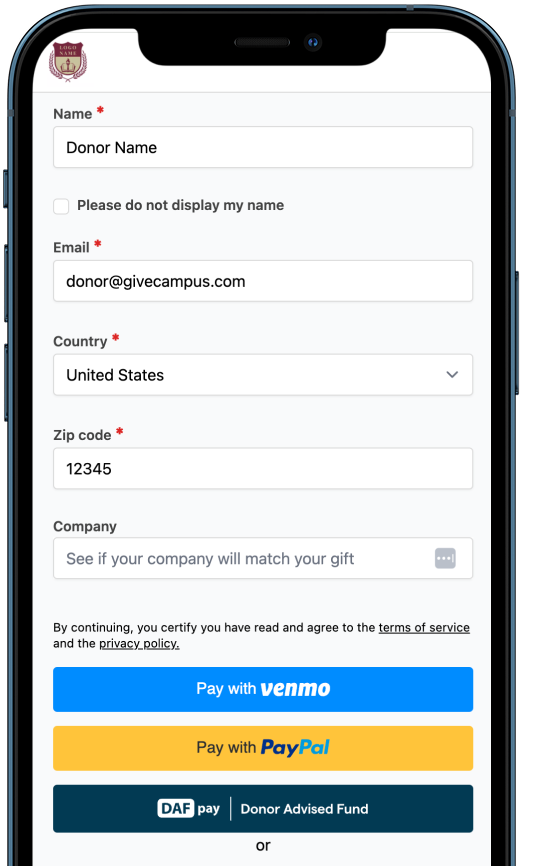

High-inclination younger donors could have access to family DAFs or smaller DAF accounts of their own—they just lack an easy way to use them. DAFpay removes that barrier—expanding access to mid-level giving for a younger audience. Plus, it turns DAF giving into a few simple clicks for a demographic that is used to quick payment methods like Venmo or other digital wallets.

DAF Best Practices for Annual Giving

- Educate Younger Donors About DAFs: Many younger donors may be unaware of how DAFs function or that they can contribute through family-established DAFs. Providing clear, accessible information can demystify the process and encourage participation.

- Highlight DAF Giving Options Prominently: Ensure that DAF giving is featured prominently on your donation page and in fundraising materials. Including a direct link or a DAF widget simplifies the giving process.

Simplify the DAF Contribution Process: Streamline the steps required to give via DAFs, ensuring the process is straightforward and mobile-friendly to cater to the expectations of younger, tech-savvy donors. Pro-Tip: The GiveCampus DAFpay integration allows DAF donors to make their gift in seconds via a simple, three-click process!

EBOOK: How to Engage Young Alumni

Leadership Giving Officers: Close the Gap between Annual and Major Gifts

Beyond just younger constituents, any donors in the $2,500–$10,000 range are often on the path to becoming major givers. But even at that level, logistical hurdles around giving from a DAF can stop a commitment in its tracks.

DAFpay allows leadership donors to make one-time or recurring gifts directly from their DAFs with ease, removing financial friction and keeping them engaged in the giving journey.

DAF Best Practices for Leadership and Major Gifts Officers

- Educate Donors on Recurring DAF Giving: Highlight that DAFs can be used for scheduled or recurring gifts—perfect for donors who want to maintain leadership-level giving over time without managing each transaction.

- Flag DAF Users in Your Portfolio: Tag or segment donors who’ve given through a DAF before. This allows you to tailor your cultivation, stewardship, and upgrade strategy for those with philanthropic assets ready to deploy.

- Use DAFs to Bridge Annual and Major Gift Conversations: If a donor isn’t ready to commit to a major gift from personal funds, explore whether a significant DAF grant could serve as a first step toward deeper involvement.

Learn how GiveCampus helps frontline fundraisers work smarter, not harder

Less Friction, More Giving—DAFpay Is a Win for Everyone in Your Advancement Office

DAFpay does so much more than provide a streamlined DAF payment option for donors. It improves operations, increases gift size and frequency, strengthens stewardship, and educates internal teams.

If you’re a GiveCampus Partner and would like to learn more about how the DAFpay integration can benefit your advancement shop, reach out to your Partner Success Manager. If you’re new to GiveCampus, and want to learn more about DAFpay and other platform features designed to help you raise more dollars from more donors, book an introductory call with one of our fundraising experts.